Real Estate Appraisers Clovis, CA

Local Estate Appraisers Clovis, CA

Clovis, CA Real Estate Appraisals

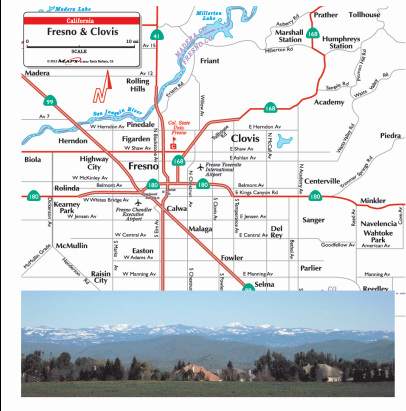

Clovis, a rapidly growing community in the San Joaquin Valley, maintains its small-town charm despite being closely linked to the Fresno metropolitan area. With strategic planning, respect for heritage, and effective leadership, Clovis has experienced well-organized growth over 25 years.

Noteworthy features, including an appealing Old Town, a distinguished educational system, top-ranked public safety departments, and stunning views of the Sierra Nevada, contribute to Clovis' status as one of the Valley's most desirable communities.

We specialize in home appraisals throughout Clovis, covering various neighborhoods and property types, from Cougar Estates to older homes in Downtown. Whether for estate, settlement, tax purposes, or real estate transactions, our experienced team is ready to provide accurate and reliable appraisals. Explore our website for detailed information or call us for personalized assistance from a licensed appraiser.

Noteworthy features, including an appealing Old Town, a distinguished educational system, top-ranked public safety departments, and stunning views of the Sierra Nevada, contribute to Clovis' status as one of the Valley's most desirable communities.

We specialize in home appraisals throughout Clovis, covering various neighborhoods and property types, from Cougar Estates to older homes in Downtown. Whether for estate, settlement, tax purposes, or real estate transactions, our experienced team is ready to provide accurate and reliable appraisals. Explore our website for detailed information or call us for personalized assistance from a licensed appraiser.

2024 Home Valuation Trends

I like to share with you a article I recently read about homes prices in the Central Valley.

The 2024 Realtor.com Housing Forecast, released on Wednesday, projects a decline in home sales and a 1.7% drop in home prices in the Fresno area. Despite these numbers, Brian Domingos, president of the Fresno Association of Realtors, suggests that the figures may not capture the entire picture. The average mortgage rate, currently at 6.8%, is expected to decrease to 6.5% by the end of 2024. Additionally, rents are projected to decrease by 0.2% in the coming year.

Realtor.com's market prediction for Fresno anticipates a challenging year, forecasting a 6% decrease in sales and a 0.3% fall in prices. Among the ten California markets analyzed, Fresno, along with San Francisco-Oakland, Stockton-Lodi, and San Jose-Sunnyvale, is one of four markets displaying negative growth in both home sales and values.

Domingos attributes the decline in home sales to the "lock-in effects," with sellers choosing to stay locked into their lower mortgage rates, either waiting or refraining from moving. He highlights that recent interest rate drops in November were not factored into the 2024 projections due to the 30-60 day escrow window. As a result, there's an expectation of a better year-end performance than initially projected.

On a national level, California markets like Oxnard-Thousand Oaks-Ventura, Riverside, and Bakersfield are expected to see growth in sales in 2024, with increases ranging from 13.4% to 18%. Danielle Hale, chief economist for Realtor.com, notes that while mortgage rates are expected to ease, high costs will continue to be a factor for existing homeowners deciding to move, but there is optimism for increased interest in the market.

The 2024 Realtor.com Housing Forecast, released on Wednesday, projects a decline in home sales and a 1.7% drop in home prices in the Fresno area. Despite these numbers, Brian Domingos, president of the Fresno Association of Realtors, suggests that the figures may not capture the entire picture. The average mortgage rate, currently at 6.8%, is expected to decrease to 6.5% by the end of 2024. Additionally, rents are projected to decrease by 0.2% in the coming year.

Realtor.com's market prediction for Fresno anticipates a challenging year, forecasting a 6% decrease in sales and a 0.3% fall in prices. Among the ten California markets analyzed, Fresno, along with San Francisco-Oakland, Stockton-Lodi, and San Jose-Sunnyvale, is one of four markets displaying negative growth in both home sales and values.

Domingos attributes the decline in home sales to the "lock-in effects," with sellers choosing to stay locked into their lower mortgage rates, either waiting or refraining from moving. He highlights that recent interest rate drops in November were not factored into the 2024 projections due to the 30-60 day escrow window. As a result, there's an expectation of a better year-end performance than initially projected.

On a national level, California markets like Oxnard-Thousand Oaks-Ventura, Riverside, and Bakersfield are expected to see growth in sales in 2024, with increases ranging from 13.4% to 18%. Danielle Hale, chief economist for Realtor.com, notes that while mortgage rates are expected to ease, high costs will continue to be a factor for existing homeowners deciding to move, but there is optimism for increased interest in the market.